Zero financial will accept their Virtual assistant home loan consult in case the finances does not fulfill them. Of several loan providers usually ask you for 24 months out-of W2s, financial statements, latest pay stubs, proof care about-work, 1099s, or other people to evaluate their yearly money. They could be also seeking their leftover terrible monthly income. A remaining gross month-to-month income is the count you have shortly after while making their biggest month-to-month financial obligation payments, along with automobile costs and you can mortgage payments.

Financial institutions have to make sure you makes their Va mortgage payment having rates in this a loan title. Thus, they estimate your debt-to-income proportion (DTI).

The level of home loan anyone are able to afford having a beneficial Virtual assistant household loan utilizes such as circumstances as their income and you will month-to-month costs. Extremely Va loans is borrowed when your mortgage payment (and additionally home loan insurance policies and assets taxation) cannot go beyond 28% of borrower’s revenues. You can borrow more substantial number that have a lowered interest to have a good Va mortgage. But not, it is important to consider exactly how much house you really can afford. Account fully for the even more expenditures, your rate of interest, and you may an excellent Virtual assistant financing commission, and you will assess the debt-to-earnings ratio to be sure you might pay back the debt within this a loan label.

Why does an excellent Virtual assistant Financing Affordability Calculator Performs?

An excellent Virtual assistant online calculator is an excellent unit getting deciding just how far household you can afford having a beneficial Va home loan. They takes into account suggestions such as your income, home price and type, and you may credit background and you can place. A good Va value calculator functions bringing home buyers having an effective particular formula one rates the likelihood of delivering investment centered on the fresh lender’s standards.

How exactly to Plan To get a home that have a good Virtual assistant Loan?

Borrowing from the bank cash is usually an accountable step, specially when considering pricey requests, like a house otherwise a vehicle. For this reason, it is important to arrange into processes and you can understand all brand new measures might bring. Before you apply to own Virtual assistant money, it’s important to make the adopting the measures:

Check your Credit file

Many lenders would like to access their borrowing from the bank to make a good financing decision. Thus, it is crucial to be certain your statement has no errors and you can your credit rating is sufficient to borrow cash to the positive conditions. When the a lender also provides an interest rate which is way too high, you have to know improving your borrowing.

Get Assistance from a trusted Financing Pro

Playing with an excellent Virtual assistant financial calculator might be shortage of understand just how much home you can afford and you will exactly what the top borrowing from the bank choice to you are. As it’s important to obtain financing instead somewhat impacting your month-to-month net income, it can be a good decision to talk a dependable financing specialist.

Generate a deposit

No matter if your Va financial will alternatively not want a downpayment, it may be an excellent solution. A down payment to suit your financing is notably decrease your Va capital payment, monthly payment, and you may interest.

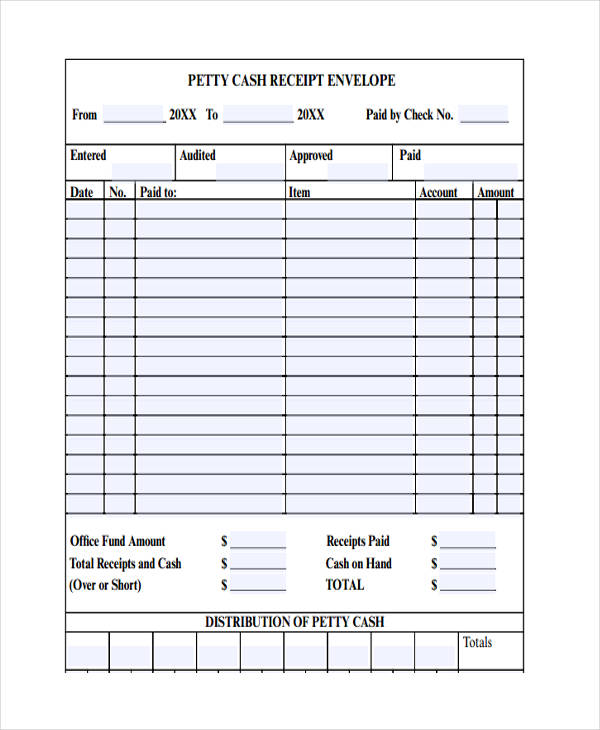

Assess The debt-To-Earnings Proportion

Figuring your own DTI makes it possible to see the review between your debt monthly payment along with your revenues. This will help to you to dictate your own possible domestic speed so you’re able to control your mortgage repayments that have financial support costs or other fees.

Perform a resources

Investing a financing fee Mosses loans, purchasing individual mortgage insurance policies, and other consequences of taking a beneficial Va home loan can notably connect with the yearly earnings. Thus, it is vital to choose how much cash domestic you can afford, choose a max home rate, and work out your own month-to-month budget description based your loan prices. Remember to consider carefully your other month-to-month expenses and money to have unexpected costs.

Kontakt

Ispunite obrazac ispod ili kontaktirajte na broj 061 616 532