The newest Homeownership Issue when you look at the Ca

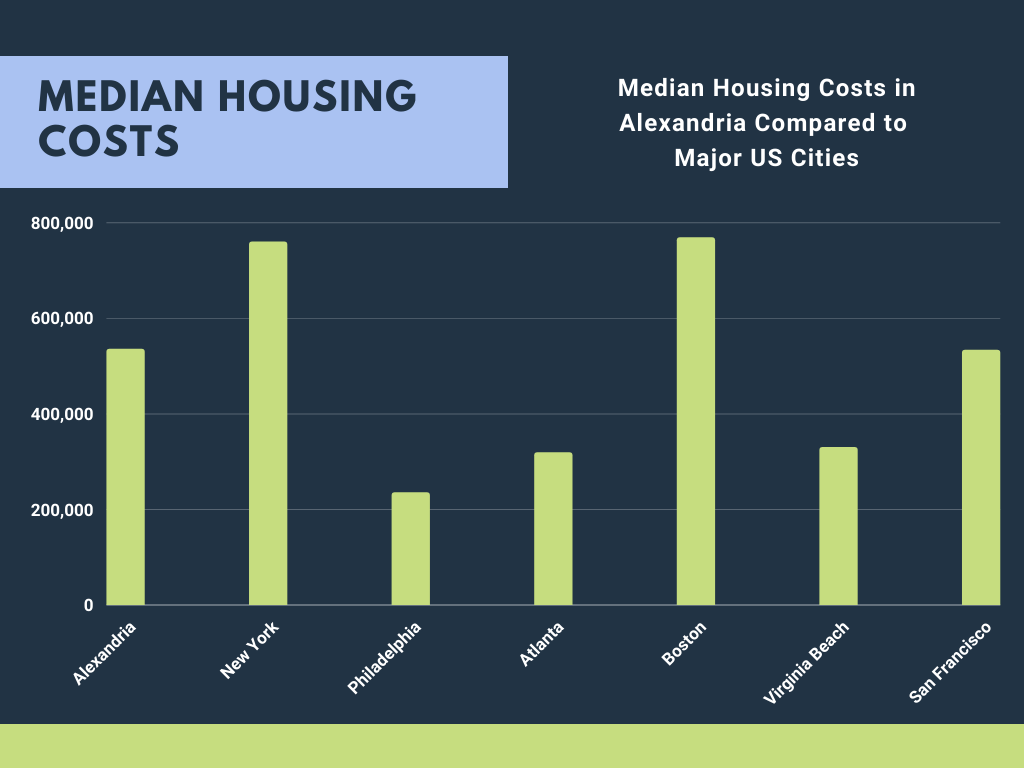

If you find yourself a tenant for the California dreaming out of homeownership, you likely become strike which includes daunting quantity. Inside the 2024, the average home price inside California are at just as much as $838,two hundred, which is nearly twice as much federal average house price of $439,455. California’s housing marketplace keeps seen an expense boost of approximately 6.9% compared to earlier in the day season, since the national sector experienced a more small rise of 4.1%.

For those in the Bay area, the difficulty is additionally more challenging, that have mediocre home values topping $one million. This really is zero short accomplishment, particularly for basic-date homebuyers.

And also make matters even more difficult, home loan prices possess increased greatly off their all-day lows from inside the 2021. By 2024, interest levels are greater than of several do pledge, and forecasts show they may perhaps not fall off notably throughout the close coming. Not surprisingly, there are various out of applications and methods which will help you earn your feet throughout the door.

Here is the Great: Ca Has the benefit of Recommendations to have Basic-Day Customers

Ca has some really complete first-time homebuyer apps in the united states, built to let tenants and renters like you overcome financial barriers and finally individual a home.

Such software usually render faster down repayments, lower rates, and assistance with settlement costs. Yet not, when planning on taking advantage of these types of apps, you must meet certain requirements. Let’s fall apart all you have to be considered.

step one. Debt-to-Earnings Ratio (DTI)

Their DTI proportion is a must during the deciding your ability to be considered getting a home loan. It ratio ‘s the percentage of their monthly earnings allocated to financial obligation costs, as well as playing cards, college loans, and vehicle costs. Most loan providers favor a great DTI proportion away from 43% otherwise reduced, however some apps might deal with higher ratios for individuals who satisfy almost every other conditions.

2. Credit score

Your installment loans in Arizona credit rating might dictate not only if or not you be considered for a loan, but also the regards to that loan, such as the interest. A good credit score usually drops on the range of 670-739, if you’re things above 740 is sophisticated.

In case the score is gloomier, don’t worry-there are credit update procedures you could apply. Simple actions such as paying down the stability, disputing errors on your credit history, and you can keeping a decreased credit application ratio can replace your score.

step 3. Income Limits

Of a lot California apps features earnings restrictions, definition your family money should be less than a particular endurance so you’re able to qualify. These limits vary because of the condition, making it essential to check out the earnings limit for your specific town. As an example, income constraints to own applications inside higher-rates nations such as the San francisco are often more than within the other areas of your county.

cuatro. First-mortgage

So you’re able to qualify for these software, you really must be a primary-go out homebuyer, identified as a person who has not yet had property before 36 months. These programs are created to assist folks who are and also make its earliest big step towards the homeownership, therefore in the event you used property, you may still be considered according to the correct criteria.

5. First House

Government entities guidance programs from inside the California is actually worried about providing somebody buy homes it intend to live in complete-big date, perhaps not resource characteristics otherwise trips residential property. The property you are to order must be much of your quarters.

six. Experienced Standing

Whenever you are a veteran, you’re in luck! California has specific software, like the CalVet Financial Program, customized to assist veterans get belongings with straight down rates and you may advantageous terminology. These benefits are part of the brand new nation’s commitment to helping men and women with served the country safer its little bit of brand new American Dream.

2024 Manner: So much more Flexible Alternatives for First-Date People

From inside the 2024, the true estate field features modified to deal with the newest lingering value facts, particularly for first-go out homeowners. Flexible mortgage solutions are way more available, providing reduce percentage conditions, closure prices direction, and also provides in certain high-request section.

On top of that, of many loan providers are in fact offering changeable-speed mortgages (ARMs) as an option to the traditional 30-year repaired-rates home loan. Whenever you are Arms come with a lot more chance (interest levels can be vary), they give all the way down 1st interest levels, that is a casino game-changer to own first-day people obtaining toward high priced segments such as the Bay Area.

The way the Cal Representatives Helps you Browse the process

In the Cal Representatives , we realize exactly how overwhelming the homebuying techniques might be-particularly in Ca. All of us works together with earliest-big date customers in order to browse new maze out of authorities software and you will resource solutions to you personally.

I also provide a totally free A residential property 101 Group to split on the whole process, of bringing pre-acknowledged having a home loan in order to closing on the dream domestic. Whether you’re simply doing the homeownership excursion or are prepared to pick today, you can expect custom guidance according to your specific financial situation.

Concurrently, we partner having respected loan providers whom focus on very first-day homebuyer applications, and we also is also link your for the greatest choices for your own need. Each lender has its own advantages and disadvantages, and you will we’re right here so you’re able to consider which ‘s the most useful complement your.

Join Our A residential property 101 Group and begin Your Excursion

If you are happy to use the step two on the homeownership, register all of us in regards to our totally free Real estate 101 Group. Our very own category discusses all you need to see, out-of expertise your credit rating so you’re able to qualifying for basic-day homebuyer applications, thus it is possible to end up being positive about to make told behavior.

Kontakt

Ispunite obrazac ispod ili kontaktirajte na broj 061 616 532