Is a dining table of your top ten Virtual assistant loan providers because of the volume and their reported minimal credit score for a beneficial Va loan. You could further contrast when you go to our very own webpage towards better Virtual assistant loan companies.

Virtual assistant Mortgage Fico scores 2023

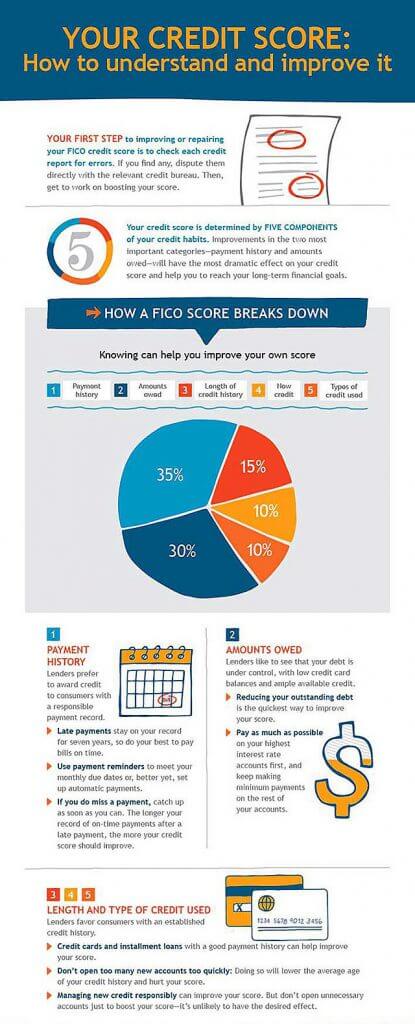

Although the Va mortgage borrowing requirements is lower than old-fashioned financing, Experts which have a variety of credit ratings need Va fund. Let me reveal a chart showing the fresh new portion of acknowledged Va Loans by Credit rating into the 2023.

Virtual assistant Financing Borrowing Requirements compared to. Almost every other Mortgage Choices

To better recognize how Virtual assistant financing borrowing from the bank standards compare with almost every other home loan choices, is a desk that measures up the financing rating minimums from all biggest mortgage issues.

Items affecting The Va Mortgage

Fico scores are not the only basis choosing if or not you meet the requirements having good Virtual assistant loan. Understanding the situations affecting the Va loan is extremely important to have Veterans trying become residents.

Debt-to-Earnings Ratio (DTI)

Your debt-to-money (DTI) proportion is another essential factor that loan providers think when contrasting your own application for the loan. The DTI is short for the newest percentage of brand new monthly gross income you to definitely would go to purchasing your fixed expenditures such as bills, fees, personal loans in Ohio charge, and you will insurance premiums.

Lenders make use of your DTI proportion as the an indication of money flow observe exactly what part of your revenue would go to fixed will cost you. Generally, loan providers choose to look for a good DTI proportion of 41% otherwise smaller getting Virtual assistant money. However, oftentimes, you might still feel recognized that have increased DTI proportion in the event that you really have compensating activities, such increased credit history or significant bucks supplies.

In order to determine your own DTI proportion, sound right all month-to-month loans costs, in addition to credit cards, vehicles money, and other finance, and split that complete by your gross month-to-month earnings. Such, if the full month-to-month debt costs is $1,five hundred as well as your terrible monthly earnings is actually $5,000, their DTI ratio was 30%.

Credit score

Lenders make use of your credit history to confirm how good you have treated borrowing prior to now. Whether or not previous results isn’t necessarily a beneficial predictor out of upcoming results, its a helpful tool having loan providers.

A number of prior blemishes might not effect your odds of delivering a Va Mortgage, and is important to keep in mind that present credit history sells more excess body fat than simply older credit score. Therefore, cleaning your credit score for several months before applying to possess a new loan is perfect when you have got recent credit circumstances. With less than perfect credit may also change the interest levels and you may fees associated with an effective Virtual assistant financing, making it imperative to examine alternatives.

Simple tips to Improve your Credit rating

Taking a Virtual assistant mortgage with poor credit can be problematic, but it is not impossible. When you yourself have the lowest credit history, you will find some things you can do to switch it. Below are a few tips:

Exactly what do I actually do if the my personal Virtual assistant application for the loan are declined?

- Demand guidance throughout the mortgage administrator on the improving your recognition chances.

- Feedback your credit history when it comes to mistakes otherwise inaccuracies and you can argument all of them if required.

- Repay people outstanding expenses and maintain the bank card balance lower.

- Spend your expenses timely and give a wide berth to trying to get the latest borrowing profile.

- Build the discounts to demonstrate loan providers that you’re economically in control.

Sure, you can buy a beneficial Virtual assistant financing which have an excellent 600 credit score, however, taking approved tends to be more complicated, and need to pay a high interest and you may/otherwise provide a larger down-payment. Lenders will additionally believe additional factors, like your income, debt-to-earnings proportion, and you can work record, whenever deciding your own eligibility for a Va financing. It is best to replace your credit score before applying for that loan to improve your odds of acceptance and safe most readily useful terms.

Kontakt

Ispunite obrazac ispod ili kontaktirajte na broj 061 616 532